The Basics of Oil Investing

Understanding the oil market and its investment opportunities is crucial for anyone looking to diversify their portfolio. This guide will introduce you to the fundamentals of oil investing, helping you navigate this complex yet potentially rewarding sector.

What Drives Oil Prices?

Oil prices are influenced by a variety of factors:

- Global supply and demand

- Geopolitical events

- OPEC decisions

- Technological advancements in extraction

- Economic growth and recessions

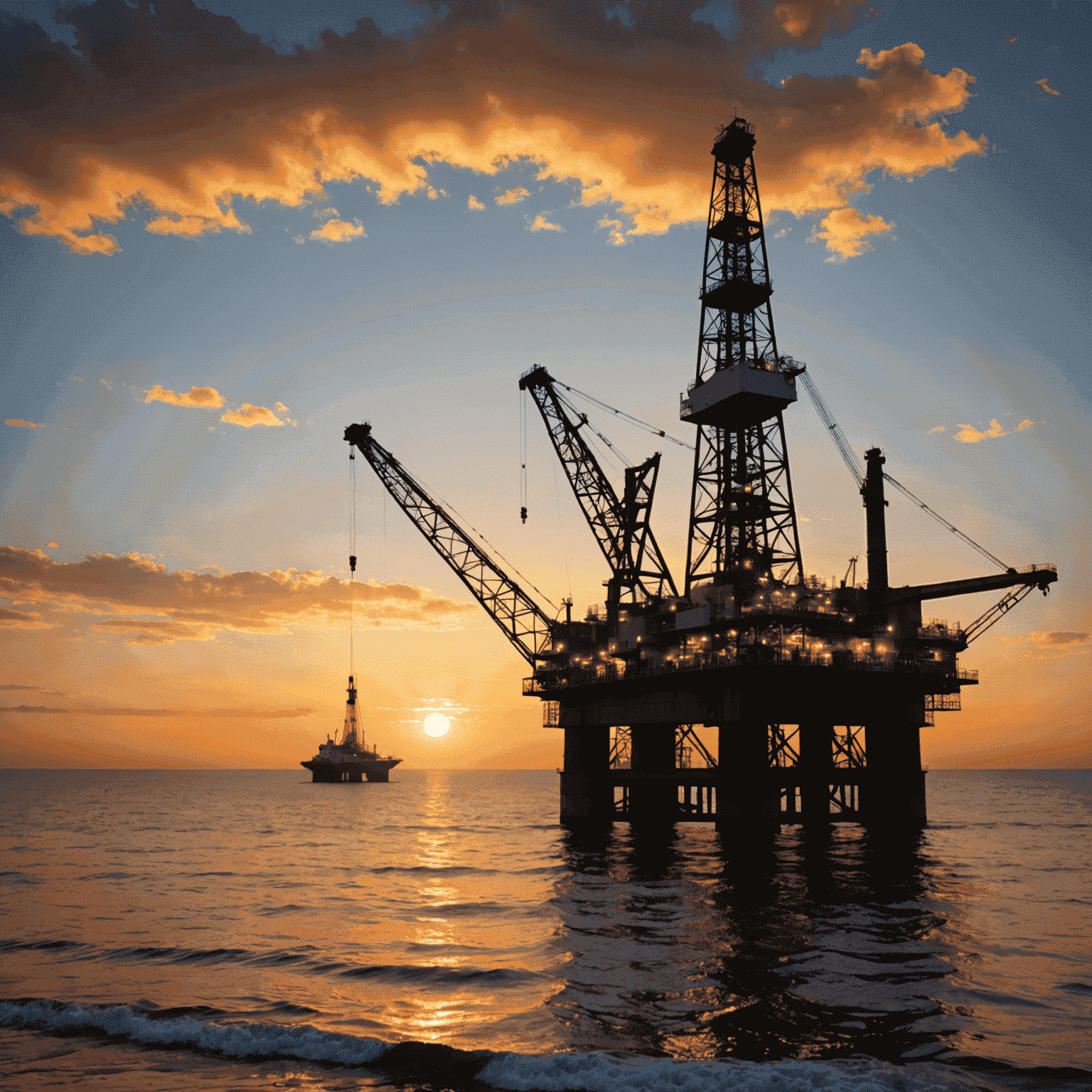

Types of Oil Investments

Investors can participate in the oil market through various channels:

- Oil Stocks: Shares in oil companies

- Oil ETFs: Exchange-traded funds that track oil prices or oil company indexes

- Oil Futures: Contracts for future oil deliveries

- Master Limited Partnerships (MLPs): Investments in oil infrastructure

Risks and Rewards

Oil investing can offer significant returns, but it's important to understand the risks:

Potential Rewards:

- Substantial profits during oil price surges

- Portfolio diversification

- Hedge against inflation

Potential Risks:

- Price volatility

- Geopolitical uncertainties

- Environmental concerns and regulations

Getting Started

To begin your journey in oil investing:

- Educate yourself about the oil industry and market dynamics

- Start with a small investment to gain experience

- Diversify your oil investments across different types

- Stay informed about global events affecting oil prices

- Consider consulting with a financial advisor specializing in commodities

Conclusion

Oil investing can be a valuable addition to your investment strategy when approached with knowledge and caution. By understanding the basics outlined in this guide, you're taking the first step towards potentially maximizing your returns in the oil sector. Remember, as with any investment, it's crucial to conduct thorough research and consider your risk tolerance before making decisions.